3 payment notification emails you should be sending

Sending important payment notifications to your customers is a great way to boost revenue. These are the top three you should start sending today!

If you collect payment in your application, either it is recurring for subscriptions or for one-time charges, here are 3 important payment notifications you should be sending to your customers.

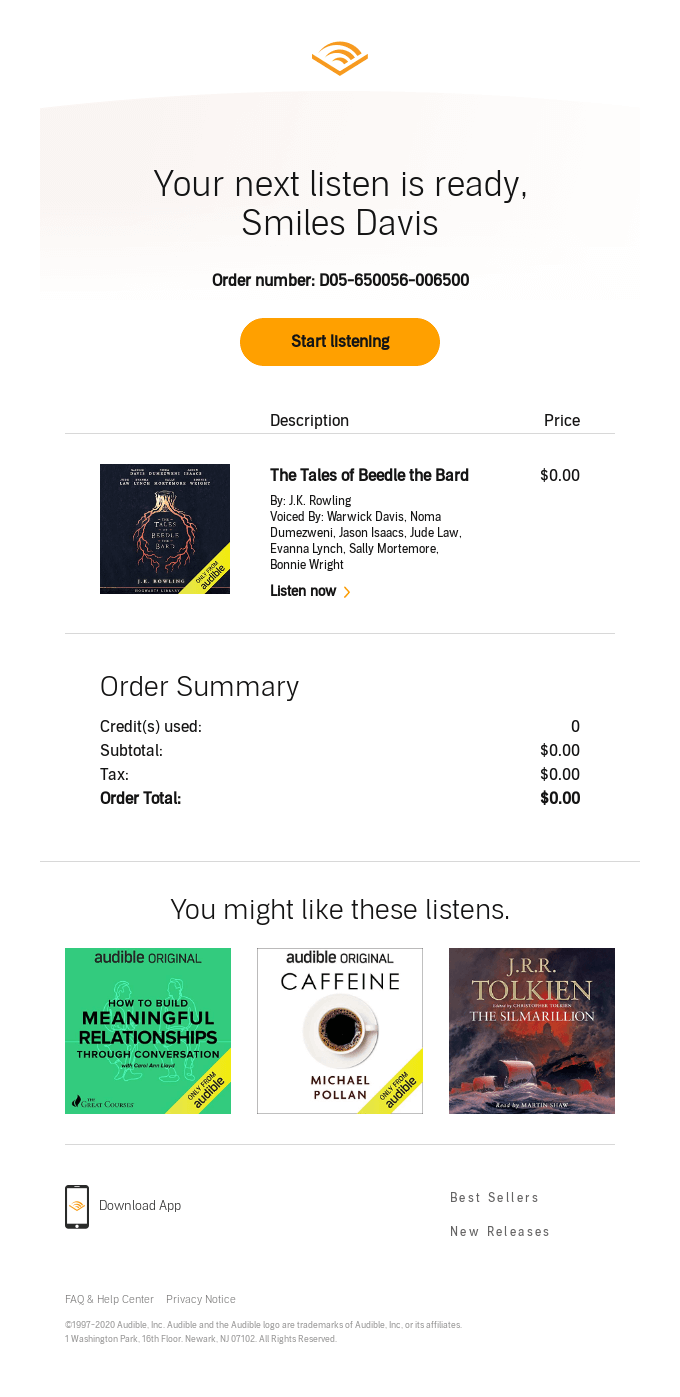

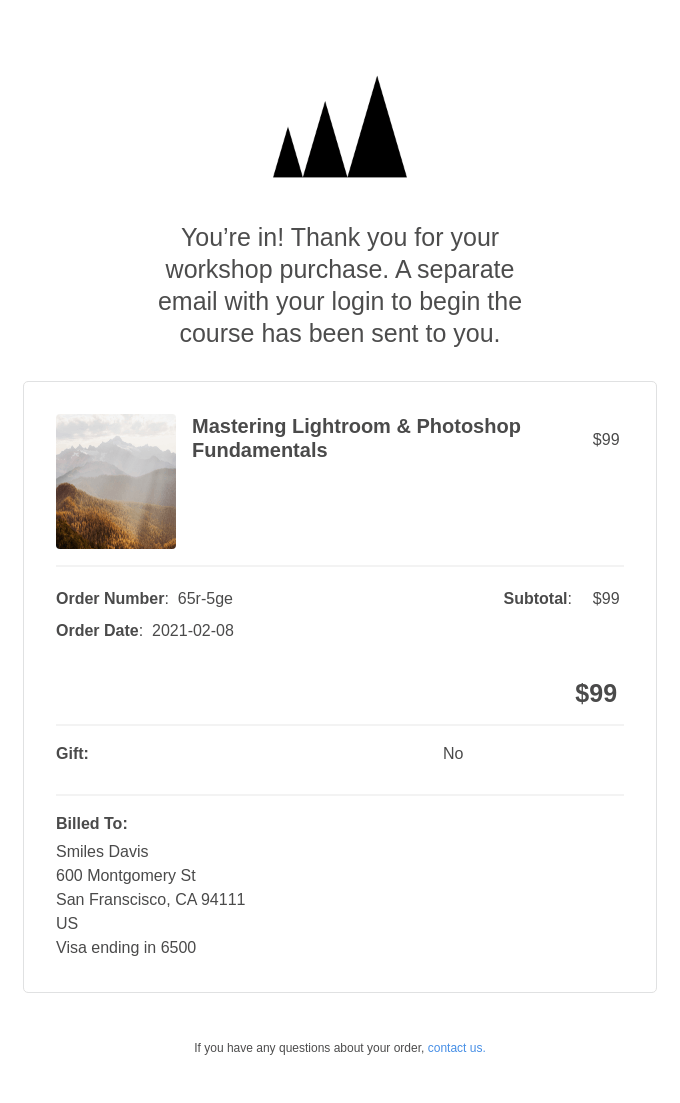

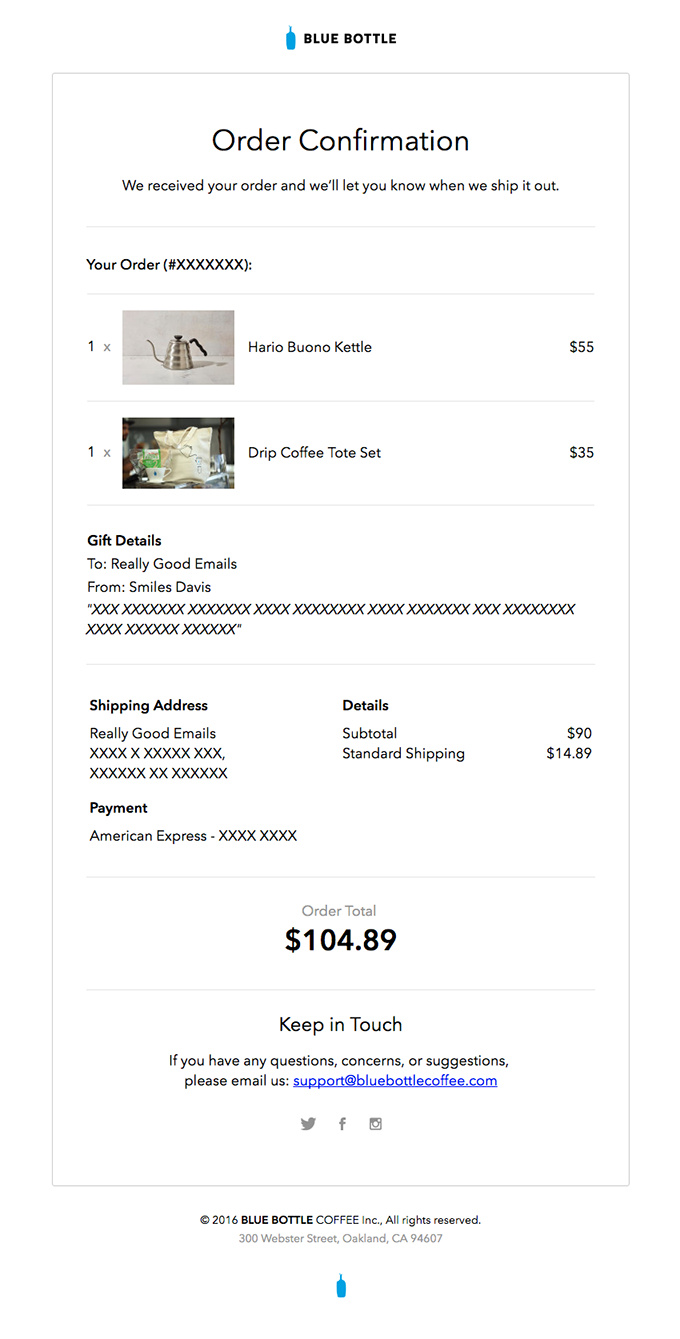

1. Successful payment notification and receipt

When a customer makes a payment either for a one-time charge or for a subscription, you should send a payment confirmation or notification receipt. By default, your payment gateway probably sends this automatically, which is totally fine. However, you can customize that experience and send this yourself to use your own branding or update the notification content. Stripe for example lets you turn off automatic sending of receipts in case you want to do it yourself.

Engage + your payment gateway

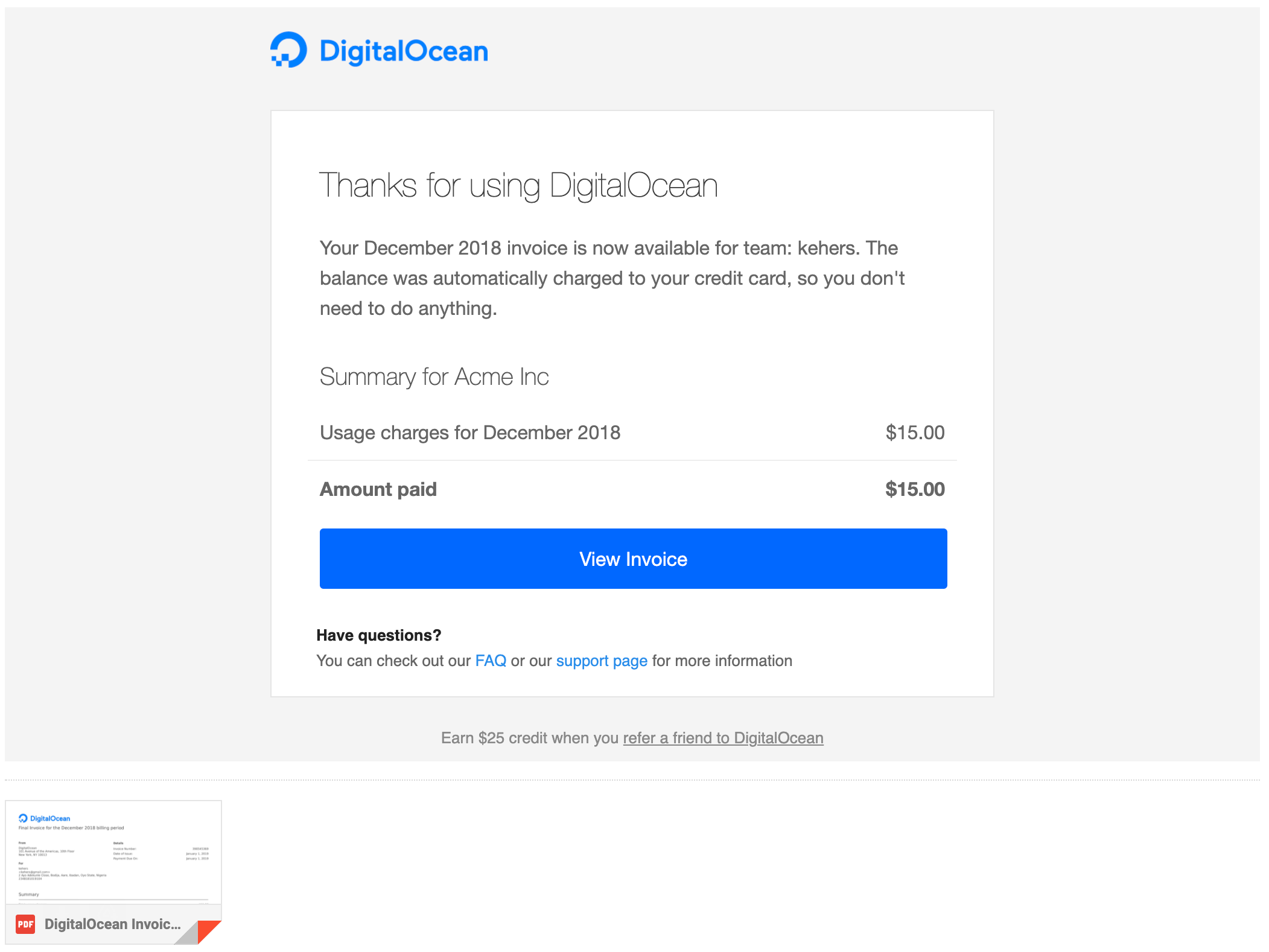

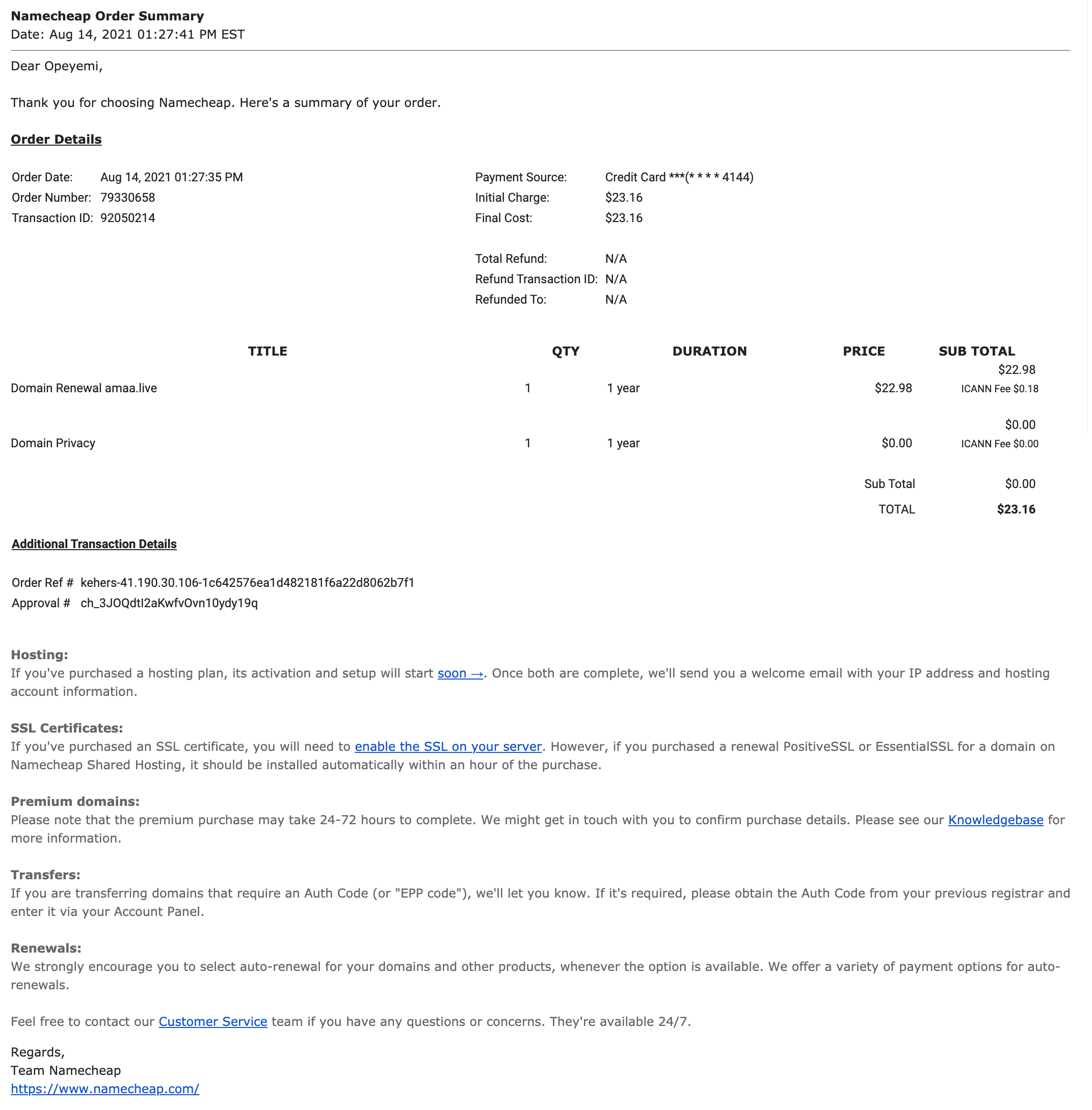

Here are one-time payment examples:

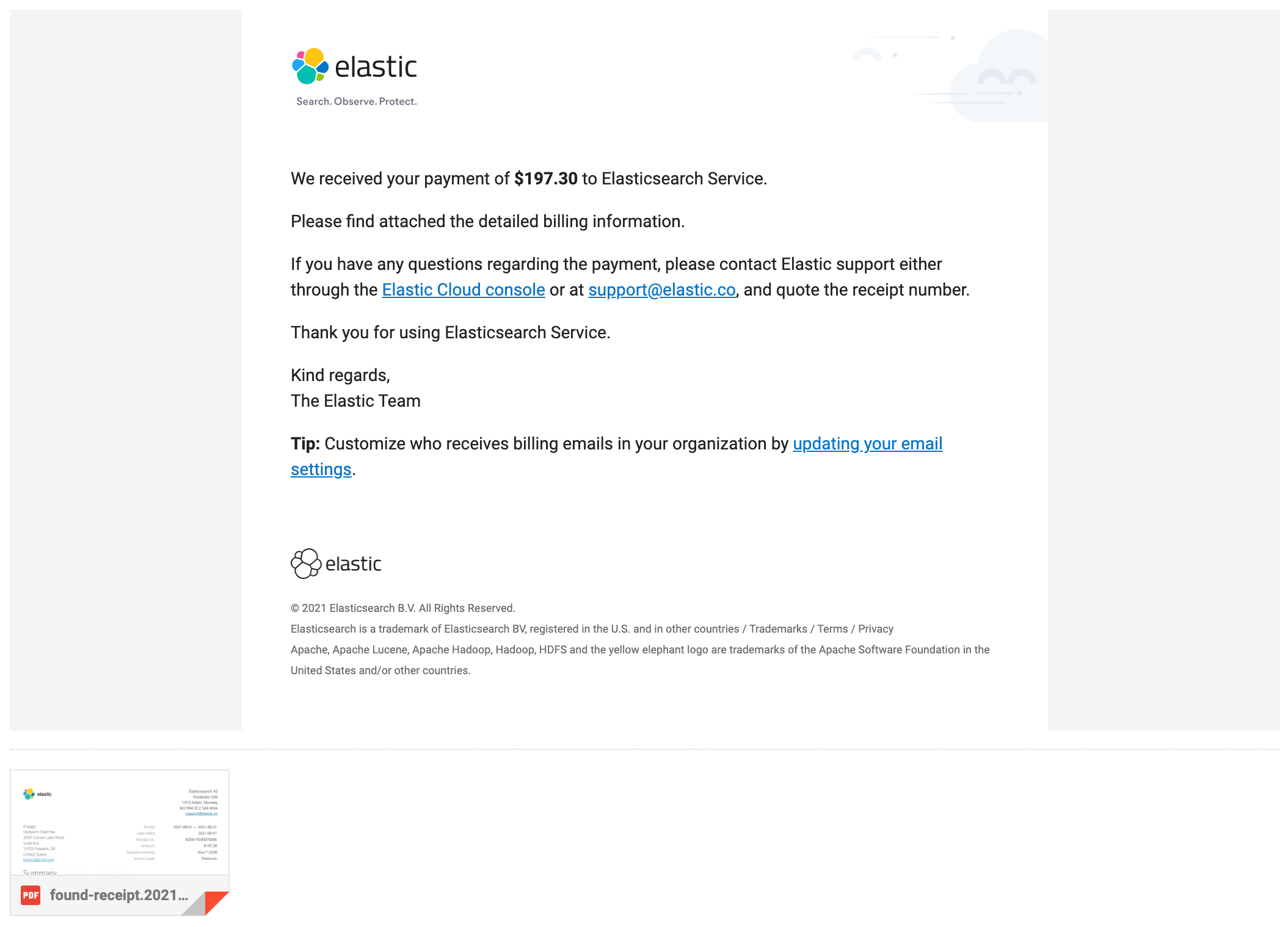

Here are examples of recurring subscription charges:

Tips

- Keep it simple:

It may be tempting to use the email to upsell or share other information but don’t make it too long or overly verbose. I like that Namecheap’s order notification receipt is detailed but it is too much content and difficult to read.

- Do a breakdown.

When possible, list the items that make up the charge. If it’s a lot of items, it is okay to show just a few and the total amount. - Attach or link to the downloadable receipt.

If you can, attach or link to a downloadable receipt in PDF. This makes it easy to store for record-keeping. If you link to the receipt, some mail clients, Gmail for example, will automatically add the file as an attachment. (See the DigitalOcean and Elastic examples above).

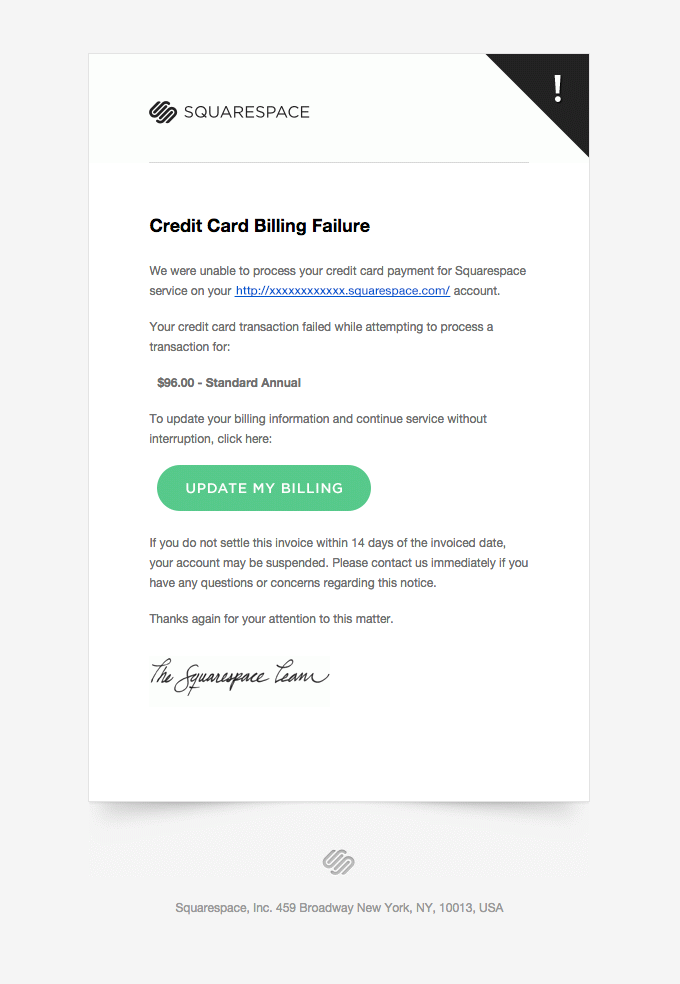

2. Failed subscription renewal

When a subscription renewal fails, you need to let the customer know. The reason is that unlike with failed one-time charges that occur during payment, the customer is unaware their card is being attempted and has failed. If a notification is not sent to the customer, they may not be aware and this would lead to churn.

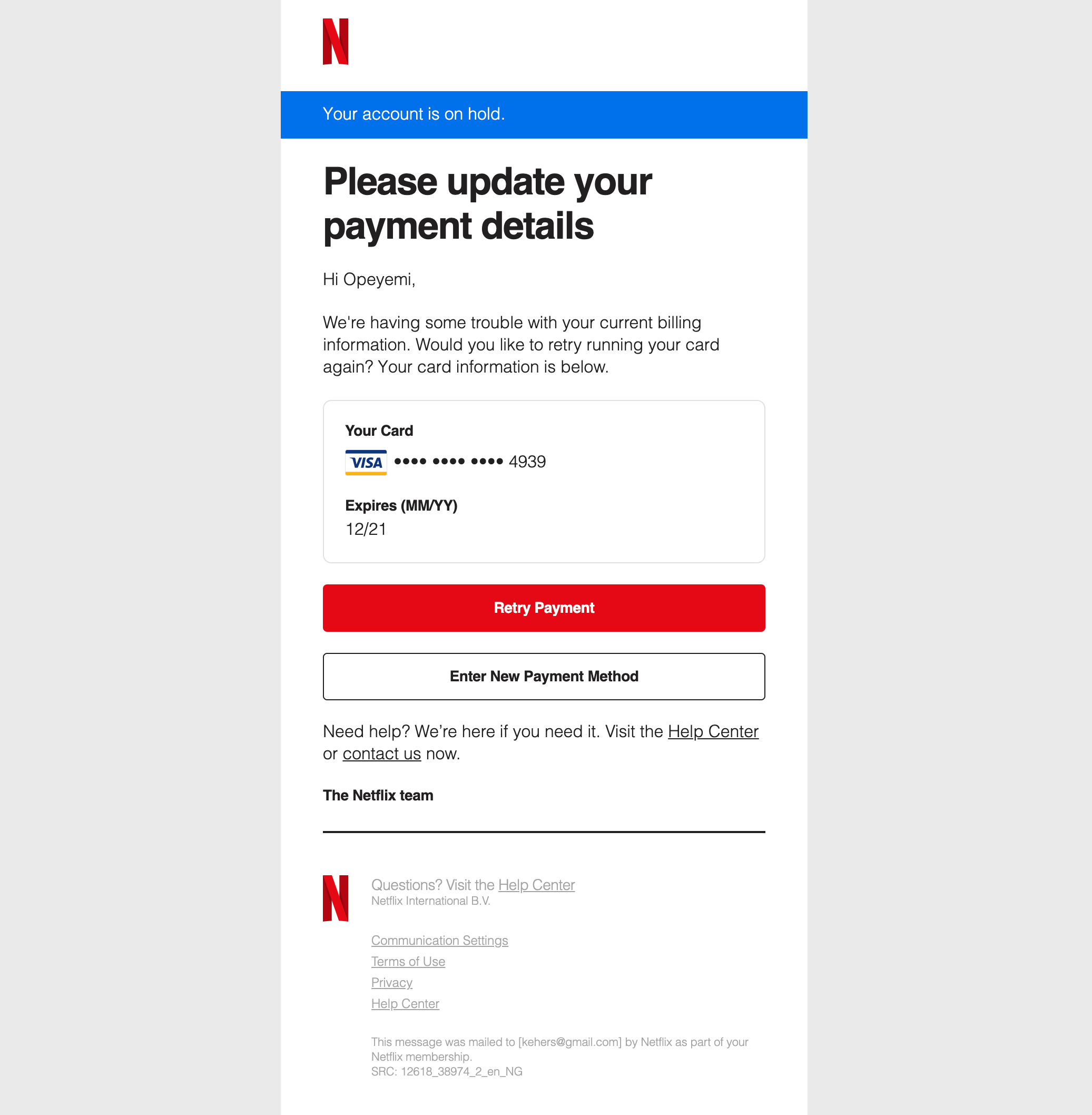

Here are two examples from Netflix and Squarespace.

Tips

- As usual, keep it simple.

- Clearly communicate consequences but keep it subtle.

Would their account be removed after a period of time or they will be downgraded? Let them know this, reassuring them there is no need to panic. - Recommend next steps to take.

Guide them on how to resolve this. This could be as simple as telling them to update their billing details, replying to the email or contacting support.

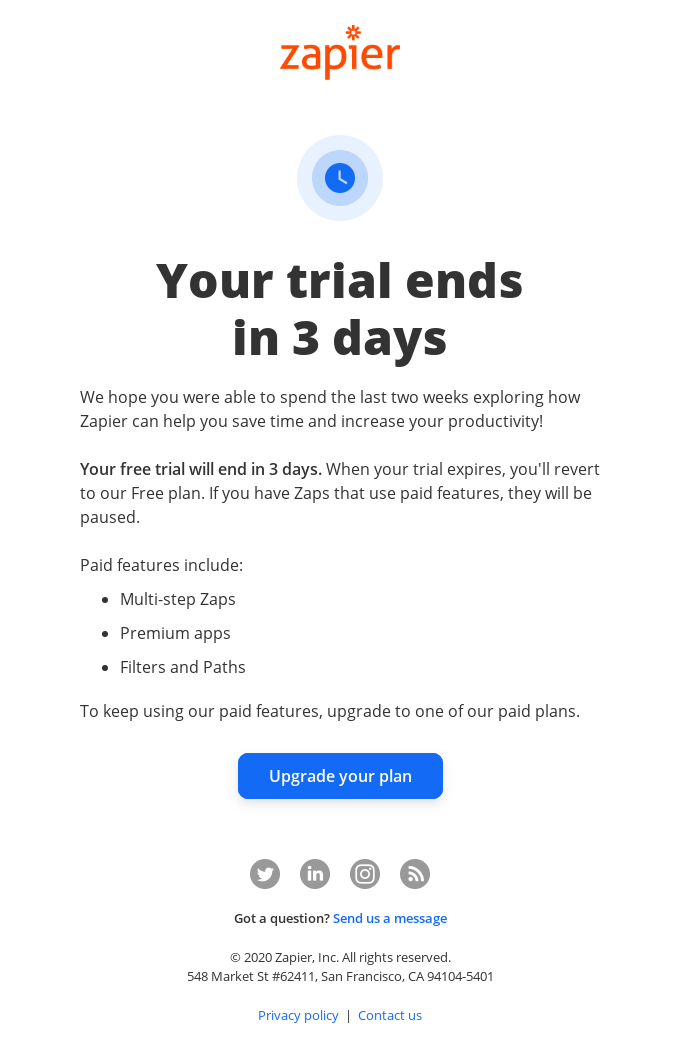

3. Trial will end

When customers subscribe to a trial for a plan, as soon as the trial period is almost over, let them know they will be charged and tell them what for. Sometimes, these customers have forgotten about the trial and may no longer be interested in the subscription. Charging them all of a sudden can lead to chargebacks that can hurt your business.

Tips

- Convince customers.

The email is a good place to convince customers on why they should convert and what features they should expect access to. - Be clear on next steps.

Should they choose to not continue with the subscription, let them know how to cancel the subscription and not be charged.

How to set up payment notifications

The process of setting up payment notifications will depend on your payment gateway. However, what is important is to have a way to know when these events occur. The way it usually works is you subscribe to events with your payment gateway to get real-time notification of these events. You can then build a messaging service at the receiving end to send the necessary notification to customers.

Engage offers an even easier option to achieve this without having to worry about the tiny details or technical resources. If you use Stripe for payments, you can connect your Stripe account to Engage for customer data enrichment, segmentation and automated billing notification and reminders. Learn more.