Optimizing KYC And User Onboarding Process For Fintech

In this article, we will discuss how Fintech companies can optimize their KYC and user Onboarding process with automation on Engage.

Conversion and continuous product usage are the goals for most Saas products but before that, you need to ensure that your users are properly activated.

For Fintech companies. Know Your Customer (KYC) is a crucial activation process that users have to complete before they can fully get value from the product.

The KYC process differs from product to product but most times it usually involves uploading an ID or other document, taking a facial selfie, providing a Bank Verification Number(BVN), and so on.

Most time this process creates multiple friction points for new users as you will need to confirm the customer identity, assess risk, and then onboard them properly.

The truth is, with these multiple frictions, you are at risk of losing these customers at each stage of the process if it’s not properly managed.

That’s why a thoughtful know-your-customer (KYC) campaign is crucial. Each abandon point is also an opportunity to deepen engagement and bring your customer fully on board.

In this article, we will look at

What is KYC?

Know Your Customer(KYC) are regulations required by financial institutions to have a clear picture of who their customers and clients are by verifying their identity; meaning, they know their customers.

This makes it easier for Fintech to spot instances of suspected money laundering, terrorist financing, and other financial crimes and empowers federal agencies “follow the money” when a crime has been committed by an individual.

Losing customers in the sales funnel is one of the challenges faced by fintech when it comes to the KYC processes.

Fintech’s competitive market is forcing brands to make customer onboarding as quick and effortless as possible but KYC compliance is key to avoid attracting fraudsters and criminals.

Even with that, Fintech brands must balance the necessary steps for KYC compliance with the efficiency customers expect in a great experience.

To increase customer conversions and prevent drop-offs, most websites and applications try to manage and limit friction as much as possible.

The less friction, the easier it is for a customer to open an account, and the more a business can grow.

Steps to a Better Fintech KYC Process

- Collect Important personal information First

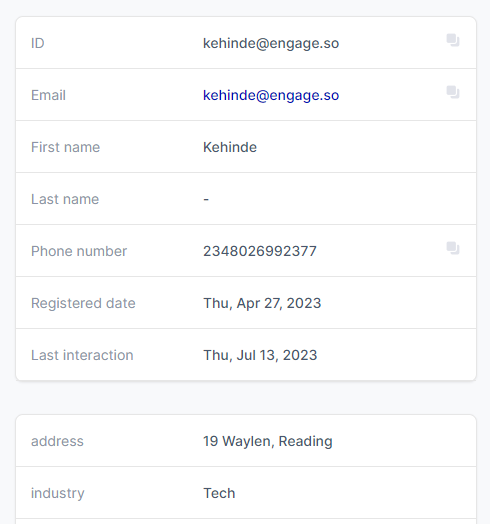

To nurture customers, you must have a means through which you communicate with them. The very first step in every successful KYC process is to collect your customer's contact info so you can guide them through the verification steps — and nudge them when they drop off.

Encourage and ensure that your customer creates an account with their name, email address or phone number, and a password as the first step in the process before you ask any verification questions.

Once you have all your customer-relevant data, Engage gives you total control to implement a cross-channel approach to nurture customers using email, SMS, and Push channels, leveraging whatever data you send to the platform.

2. Build An Onboarding Campaign Around Your Key Event

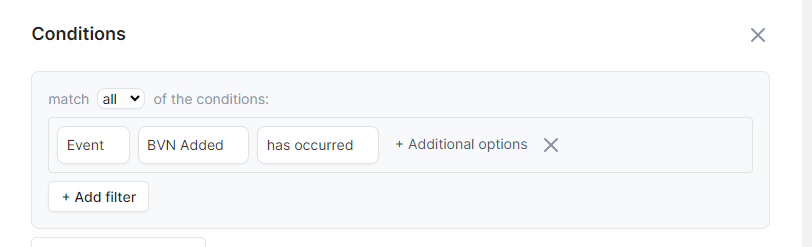

Most times, there are several steps in the verification process and each of these steps is a potential drop-off point. Still, there are likely to be key actions or events along the process which are important to the whole verification process.

Identify these important events and create campaigns to catch them at those key milestones.

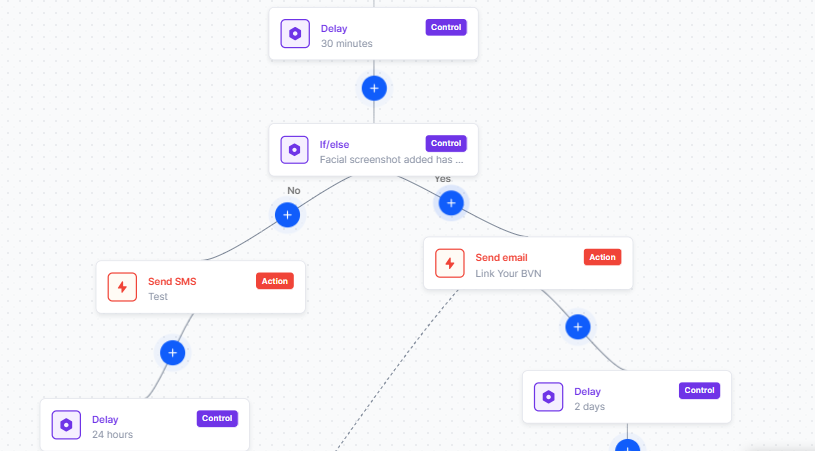

For instance, if you know that linking a bank account or Bank Verification Number(BVN) is a key indicator of a customer’s long-term success, build campaigns and messaging that react to whether they’ve completed that milestone.

With Engage, you can assign conversion goals to each campaign, allowing you to personalize the onboarding experience based on customer actions.

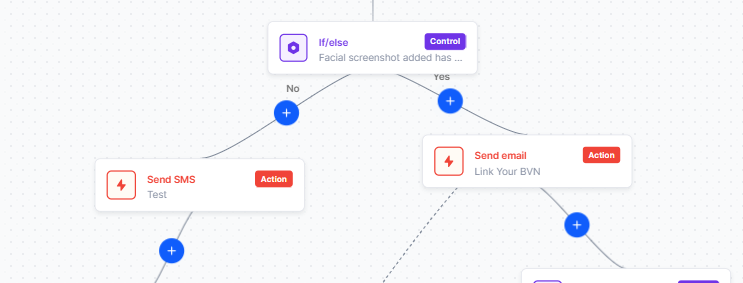

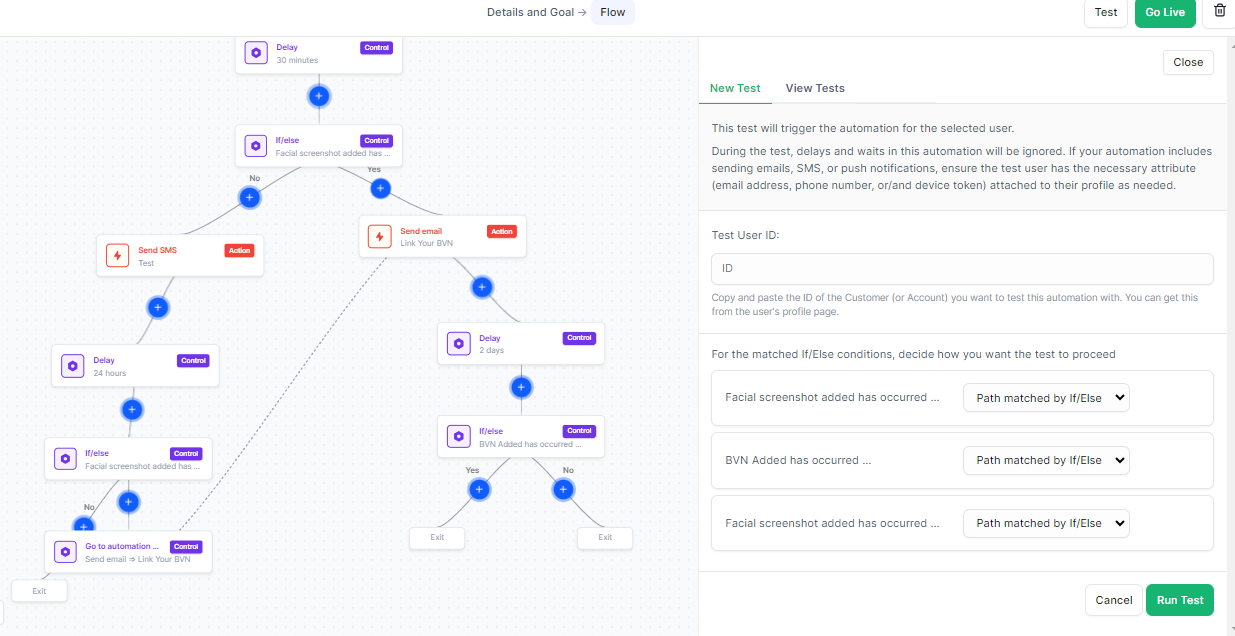

You can use the If/Else statement in your onboarding workflow to check if certain action has taken place then send different messages based on how and when the customer completed a previous action, and include a “wait until” step to hold off on further messaging until they complete a milestone.

3. Send Personalized Messages based on drop-offs and Events

Nothing beats personalized customer engagement. The more personalized your messages, the more likely customers will respond. So show your customers that you know what matters to them!

For instance, If someone came in through your referral page, started the KYC process, and exited after being asked to take a selfie or link their BVN, don’t follow up with a general message that doesn’t address that issue or other product offerings.

Use that data to get them back on track to the product that sparked their interest so they can complete their verification process.

4. Use Different Channels Of Communication.

Customers are bombarded with so many emails, that your message may end up not being seen, adopt other means of engagement like SMS, push notification, and in-app messaging channels.

Doing this you can be rest assured that your customers will see at least one out of those messages.

Engage supports several messaging channels and allows you to include any or all of these channels in your automation workflow.

5. Test Your Entire Messaging Journeys, Not Just Individual Messages

The KYC verification process is a multi-step journey with one goal at the end of the tunnel which is to successfully get customers to complete the process so they can start using and getting value from your product or service.

You need to be sure all your campaign(flow) works as intended. So test the effectiveness of your entire messaging campaign as a whole based on your ultimate conversion goal.

Engage gives you the privilege to test your workflow as a whole so you know how well your campaign flow works.

Conclusion

With more and more competitors entering the fintech space, you need to stay ahead by lowering the barriers associated with KYC verification by increasing customer engagement via personalized messaging through multiple channels.

Customers are bound to drop off at different stages of the verification process and create audience segments and personalized campaigns to nurture them over time. This is your opportunity to build a relationship: guide them to the next step while also providing valuable and relevant content.

Create a KYC and Onboarding campaign for your Fintech Company.

Get Started For Free